Foreign Exchange→buying and selling of currency

EX) In order to purchase souvenirs in France, it is first necessary for America to sell (supply) their dollars and buy (demand) Euros.

*The exchange rate (e) is determined in foreign currency markets

EX) The current exchange rate is approximately 77 Japanese yen to 1 U.S. dollar.

*Simply put: exchange rate is price of a currency

*do not try to calculate the exact exchange rate

*increase in demand of Euros relative to U.S. dollar

Saturday, April 27, 2013

Extra: Credits vs. Debits

Credits→addition to a nation's account

Debits→subtractions to a nation's account

How to Calculate the following:

1. Balance of Trade: merchandise ↓ service exports-merchandise ↓service imports (typically)

2. Trade deficit occurs when the balance on trade is negative (imports>exports)/ Trade surplus occurs when the balance on trade is positive (exports>imports)

3. Balance on current account=Balance on trade (exports & imports)+Net investment income+Transfer payments

4. Official Reserves

*nationally

Debits→subtractions to a nation's account

How to Calculate the following:

1. Balance of Trade: merchandise ↓ service exports-merchandise ↓service imports (typically)

2. Trade deficit occurs when the balance on trade is negative (imports>exports)/ Trade surplus occurs when the balance on trade is positive (exports>imports)

3. Balance on current account=Balance on trade (exports & imports)+Net investment income+Transfer payments

4. Official Reserves

*nationally

Δ in CA+Δ in FA+Δ in official reserves=not zero

Unit VII: Balance of Payments

Balance of Payments→measure of $ inflows and outflows b/t U.S. and rest of world (ROW)

- inflows referred to as "CREDITS"

- outflows referred to as "DEBITS"

They are divided into 3 accounts:

- current account

- capital/financial account

- official reserves account

Double Entry Bookkeeping:

*every transaction in balance of payments is recorded twice in accordance w/ standard accounting practice

EX) U.S. manufacturer, John Deere, exports $50 million worth of farm equipment to Ireland.

-a credit of $50 mill. to current account

(-$50 mill. worth of farm equipment or physical assets)

-a debit of $50 mill. to capital/financial account

(+$50 mill. worth of Euros or financial assets)

-notice that the 2 transactions offset (balance) each other. Theoretically, the balance payments should always =0.

Current Account:

1. Balance of Trade of Net Exports

- exports of goods & services --imports of goods & services

- exports create a CREDIT to balance of payments

- imports create a DEBIT to balance of payments

2. Net Foreign Income

- income earned by U.S. owned foreign assets--income paid to foreign held U.S. assets

- EX) Interest payments on U.S. owned Brazilian bonds--interest payments on German owned U.S. treasury bonds

3. Net Transfers (tend to be unilateral→one-sided)

- foreign aid→debit to current account

- EX) Mexican migrant workers send $ to family in Mexico

Capital/Financial Account

*the balance of capital ownership

*includes purchase of both real and financial assets

*direct investment in U.S. is a credit to capital account

EX) Toyota Factory in San Antonio

*direct investment by U.S. firms/individuals in a foreign country are debits to capital account

EX) the Intel Factory in San Jose, Costa Rica

*purchase of foreign financial assets represents a debit to capital account

EX) Warren Buffet (a wealthy man) buys stock in Petrochina

*purchase of domestic financial assets by foreigners represents a credit to capital account

EX) United Arab Emirates sovereign wealth fund purchases a large stake in NASDAQ

What Causes Capital/Financial Flows?

*differences in rates of return on investment

*Ceteris Paribus ("with other things the same" or "all other things being equal"), savings will flow toward higher returns

Relationship b/t Current & Capital Account

*current account and capital account should zero each other out (+/-; surplus/deficit)

EX) The constant net inflow of foreign financial capital to U.S. (capital account surplus) is what enables us to import more than we export (current account deficit)

Official Reserves

*foreign currency holdings of U.S. Federal Reserve System

*when there is a balance of payments surplus, the Fed accumulates foreign currency and debits the balance of payments

*when there is a balance of payments deficit, the Fed depletes its reserves of foreign currency and credits balances of payments

*official reserves zero out the balance (everything)

Reaganomics

Supply-side economics or Reaganomics:

- support policies that promote GDP growth by arguing that high marginal tax rates along w/ current system of transfer payments (i.e. unemployment compensation and social security) provide disincentives to work, invest, innovate, and take entrepreneurial adventures

- believe AS curve will determine levels of inflation, unemployment, and economics growth

Trickle-down Effect:

*Rich→poor (direction of $ flow)

Marginal Tax Rate→amount paid on last $ earned or on each additional $ earned

- Reaganomics believe if you reduce the marginal tax rate, more people will be inclined to work longer, thus forgoing leisure time for extra income.

Laffer Curve

**higher the tax rate you set, less $ you will collect

**Laffer Curve is controversial and debatable

*trade-off b/t tax rates and govt revenue

*as tax rates ↑ from 0, tax revenues ↑ from 0 to some max level, and then decline

*higher tax rates, less $ you collect

*Criticisms:

**Laffer Curve is controversial and debatable

*trade-off b/t tax rates and govt revenue

*as tax rates ↑ from 0, tax revenues ↑ from 0 to some max level, and then decline

*higher tax rates, less $ you collect

*Criticisms:

- where economy is located on curve, it is difficult to determine

- tax cuts also ↑ demand which can fuel inflation

- empirical evidence suggests that impact on tax rates on incentives to work, save, and invest are small

Friday, April 26, 2013

Phillips Curve Cont.

SRAS→=SRPC←

(imagine the direction of the arrows on the corresponding graphs below)

- inflationary expectations ↓, input prices ↓, productivity ↑, business taxes ↓, +/or deregulation

- SRAS→: GDPR↑ and PL ↓; u%↓ and π%↓

- SRPC← (disinflation)

*supply shock→rapid and significant increase in resource cost which causes the SRAS to shift

*NRU→is = to frictional, structural, and seasonal (cyclical based on economy)

- natural rates and fewer worker benefits create a lower NRU (free med. care for all workers, lay-off some b/c profits being eaten)

*misery index→combo. of inflation (2-3%) and unemployment (double digits=depression, forget a recession) in any given year. Single digit misery is good.

*if inflation rate persists and expected rate of unemployment rises, then entire SRPC moves upward. When that happens, stagflation exists.

*if inflation expectations drop (due to new tech., efficiency, etc.), the SRPC moves downward

*stagflation→↑ unemployment and ↑inflation occurring at same time

*disinflation→when inflation decreases over time

- nominal wages ↓ (good)

- business profits fall as prices ↑ (bad)

- firms reduce employment, thus, unemployment ↑

Unit VI: The Phillips Curve

u%=unemployment rate

π%=rate of inflation

*The Phillips Curve represents the relationship b/t unemployment and inflation

*trade-off b/t unemployment and inflation occurs over SR

*each point on the Phillips Curve corresponds to a different level of output

*LRPC=long run Phillips Curve

*↑ in unemployment, LRPC →

*↓ in unemployment, LRPC ←

*Increase in AD=up/left movement along SRPC

π%=rate of inflation

*The Phillips Curve represents the relationship b/t unemployment and inflation

*trade-off b/t unemployment and inflation occurs over SR

*each point on the Phillips Curve corresponds to a different level of output

*LRPC=long run Phillips Curve

- occurs at NRU

- represented by ↨ line

- no trade-off b/t unemployment and inflation in LR

- economy produces @ FE output level

- nominal wages of workers fully incorporates any changes in PL as wages adjust to inflation over the LR

*↑ in unemployment, LRPC →

*↓ in unemployment, LRPC ←

*Increase in AD=up/left movement along SRPC

- C↑, Ig↑, G↑, and/or Xn↑

- AD→: GDPR↑ and PL ↑; u%↓ and π%↑; up/left along SRPC

- this would be depicted in the graph below

- C↓, Ig↓, G↓, and/or Xn↓

- AD←: GDPR↓ and PL↓; u%↑ and π%↓; down/right along SRPC

- in this case, point B would move to point A in the graph below

**Check out this blog for more info. on the Phillips Curve and other economic topics: http://macroeconomic1.wordpress.com/

Unit V: AD/AS: From SR to LR

*AS curve doesn't shift in response to changes in the AD curve in the short run

- i.e.-nominal wages do not respond to PL changes

- workers may not realize impact of the changes or may be under contract (i.e. teachers don't get paid more for tutorials)

*Long run (vertical)-prd in which nominal wages are fully responsive to previous changes in PL

*when changes occur in the SR, they result in either increased/decreased producer profits-not changes in wages paid

*in the LR, increases in AD result in a higher PL. As in SR, but as workers demand more $, the AS curve shifts left to equate production @ the original output level, but now @ a higher price.

*in the LR, the AS curve is vertical (LRAS) @ the natural rate of unemployment (NRU), or FE level of output. Everyone who wants a job has one and no one is enticed (lured or tempted) into or out of market.

*Demand-pull inflation will result when an increase in demand shifts the AD curve to →, temporarily increasing output while raising prices.

*Cost-push inflation results when an increase in input costs that shifts the AS curve to ←. In this case, the PL increase is not in response to ↑ in AD, but instead the cause of PL increasing. (in a recession, AD ↓ and shifts ←)

Sunday, April 14, 2013

Monetary & Fiscal Policy (during a recession)

Monetary Policy

(Recession)

|

International Trade

|

Fed will:

1. Buy bonds

2. Lower

RR

3. Lower

DR

4. Lower

FF

all contribute to:

MS ↑, i ↓, Ig ↑, AD ↑,

GDP ↑

**opposite occurs during inflationary prd

|

D $ (demand for $) ↓

↓

$ depreciated (value of $ goes ↓)

↓

Exports ↑ (cheaper)

↓

Xn ↑

↓

AD ↑

↓

GDP ↑

|

Fiscal Policy

(Recession)

|

International Trade

|

-congress will cut taxes or ↑ govt spending

-consumption and govt spending will ↑

-AD will ↑

-GDP ↑

-Deficit→supply of LF ↓ (none to loan out)

↓

I (interest) ↑

Ig ↓

|

D $ ↑

↓

$ appreciate (increase in value)

↓

Exports ↓

↓

Net exports ↓

↓

AD ↓

↓

GDP ↓

|

Wednesday, April 10, 2013

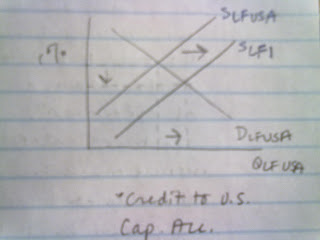

Loanable Funds Market

Loanable Funds Market (LF)→market where savers and borrowers exchange funds (QLF) @ real rate of interest (r%)

- D for LF, or borrowing comes form households, firms, govt, and foreign sector. DLF is supply of bonds

- SLF, or savings comes from households, firms, govt, and foreign sector. SLF also demand for bonds.

- more borrowing=more demand for LF (→)

- less borrowing=less demand for LF (←)

- =more DLF (DLF→, r% ↑)

- less DLF (DLF ←, r% ↓)

- more saving=more SLF (→)

- less saving=less SLF (←)

- more SLF (SLF →, r% ↓)

- less SLF (SLF ←, r% ↑)

Multiple Deposit Expansion

How Banks Work:

|

Assets

|

Liabilities & Equity

|

|

-Reserves

·

Required reserves (RR)→% required by Fed. To keep

on hand to meet demand.

·

Excess reserves (ER)→% reserves over and above

the amount needed to satisfy minimum reserve ration set by Fed.

-loans to firms, consumers, and other banks (earns interest)

Loans to govt=treasury securities

-bank property—if bank fails, you could liquidate the building/property

|

-Demand Deposits ($ put into bank)

-timed deposits (CD’s)

-loans from: Federal reserve and other banks

-Shareholders’ Equity→to set up a bank, you must invest your own $ in

it to have a stake in bank’s success/failure

|

Reserve Requirement:

- Fed requires banks always have some $ readily available to meet consumers' demands for cash

- amount (set by Fed) is Required Reserve Ratio

- required RR is % of demand deposits (checking account balances) must NOT be loaned out

- typically RR ratio=10%

0.05x$1000=$50 in reserve ratio

How much $ can bank loan out?

1000 (deposited) - 50 (reserve ratio) = $950 loaned out to next borrower

EX 2) Scenario: 100% Reserve Banking: Now suppose households deposit $1000 @ "Firstbank"

- falls under liabilities (claims of non-owners)

- reserves=$1000 under assets (each side must balance)

EX 3) Scenario: Fractional Reserve Banking: Suppose banks hold 20% of deposits in reserve, making loans w/ the rest

-Firstbank will make $800 in loans

|

Assets

|

Liabilities

|

|

Reserves $200

Loans $800

|

Deposits $1000

|

-$ supply now=$1800

-depositor still has $1000 in demand deposits (but borrower now holds $800 in currency)

**In a fractional reserve banking system, banks create $.

Required Reserve Ratio:

-% of demand deposits that must be stored as vault cash or kept on reserve as Federal funds in the bank's account w/ Federal Reserve

-Required Reserve Ratio determines the $ multiplier (1/reserve ratio)

- Decreasing the reserve ratio increases rate of $ creation in banking system and is expansionary

- Increasing the reserve ratio decreases rate of $ creation in banking system and is contractionary

Money Multiplier:

-shows us impact of change in demand deposits on loans + eventually the $ supply

-indicates total # of dollars created in banking system by each $1 addition to monetary base (bank reserves + currency in circulation)

-to calculate $ multiplier, divide 1 by required reserve ratio

$ multiplier=1/reserve ratio

EX) if reserve ratio is 25%, multiplier=4

4 Types of Multiple Deposit Expansion Questions:

- Type 1: Calculate initial change in ER aka amount a single bank can loan from initial deposit

- Type 2: Calculate change in loans in banking system

- Type 3: Calculate change in $ supply **sometimes Types 2&3 will have same result if there is no Fed involvement

- Type 4: Calculate change in demand deposits

the amount of new demand deposits - required reserve=initial change in ER

$100 mill. - (20% x $100 mill.)

$100 - 20 = $80 mill. in ER

EX 2) Maximum change in loans in banking system.

initial change in ER x $ multiplier=max change in loans

$80 mill. x (1/20%)

$80 mill. x 5 = $400 mill. max in new loans

EX 3) Maximum change in $ supply.

maximum change in loans + $ amount of Federal Reserve action

$400 mill. + $100 mill.=$500 mill. max change in $ supply

EX 4) Maximum change in demand deposits.

maximum change in loans + $ amount of initial deposit

$400 mill. + $100 mill. = $500 mill. max change in demand deposits

Subscribe to:

Comments (Atom)