Balance of Payments→measure of $ inflows and outflows b/t U.S. and rest of world (ROW)

- inflows referred to as "CREDITS"

- outflows referred to as "DEBITS"

They are divided into 3 accounts:

- current account

- capital/financial account

- official reserves account

Double Entry Bookkeeping:

*every transaction in balance of payments is recorded twice in accordance w/ standard accounting practice

EX) U.S. manufacturer, John Deere, exports $50 million worth of farm equipment to Ireland.

-a credit of $50 mill. to current account

(-$50 mill. worth of farm equipment or physical assets)

-a debit of $50 mill. to capital/financial account

(+$50 mill. worth of Euros or financial assets)

-notice that the 2 transactions offset (balance) each other. Theoretically, the balance payments should always =0.

Current Account:

1. Balance of Trade of Net Exports

- exports of goods & services --imports of goods & services

- exports create a CREDIT to balance of payments

- imports create a DEBIT to balance of payments

2. Net Foreign Income

- income earned by U.S. owned foreign assets--income paid to foreign held U.S. assets

- EX) Interest payments on U.S. owned Brazilian bonds--interest payments on German owned U.S. treasury bonds

3. Net Transfers (tend to be unilateral→one-sided)

- foreign aid→debit to current account

- EX) Mexican migrant workers send $ to family in Mexico

Capital/Financial Account

*the balance of capital ownership

*includes purchase of both real and financial assets

*direct investment in U.S. is a credit to capital account

EX) Toyota Factory in San Antonio

*direct investment by U.S. firms/individuals in a foreign country are debits to capital account

EX) the Intel Factory in San Jose, Costa Rica

*purchase of foreign financial assets represents a debit to capital account

EX) Warren Buffet (a wealthy man) buys stock in Petrochina

*purchase of domestic financial assets by foreigners represents a credit to capital account

EX) United Arab Emirates sovereign wealth fund purchases a large stake in NASDAQ

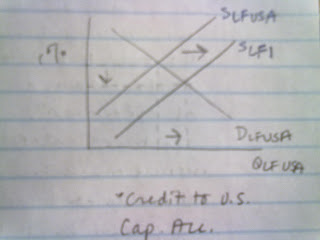

What Causes Capital/Financial Flows?

*differences in rates of return on investment

*Ceteris Paribus ("with other things the same" or "all other things being equal"), savings will flow toward higher returns

Relationship b/t Current & Capital Account

*current account and capital account should zero each other out (+/-; surplus/deficit)

EX) The constant net inflow of foreign financial capital to U.S. (capital account surplus) is what enables us to import more than we export (current account deficit)

Official Reserves

*foreign currency holdings of U.S. Federal Reserve System

*when there is a balance of payments surplus, the Fed accumulates foreign currency and debits the balance of payments

*when there is a balance of payments deficit, the Fed depletes its reserves of foreign currency and credits balances of payments

*official reserves zero out the balance (everything)

*active vs. passive

Helpful Guide: